How Custom Private Equity Asset Managers can Save You Time, Stress, and Money.

Wiki Article

Custom Private Equity Asset Managers Fundamentals Explained

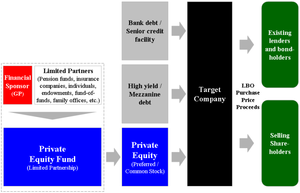

(PE): spending in companies that are not openly traded. About $11 (https://holistic-hockey-df2.notion.site/Unlocking-Wealth-Exploring-Private-Investment-Opportunities-with-Custom-Private-Equity-Asset-Manage-9a6dee69d573415d908b1abc0221059b?pvs=4). There might be a few things you don't comprehend concerning the industry.

Personal equity firms have a variety of investment preferences.

Since the most effective gravitate towards the larger offers, the middle market is a dramatically underserved market. There are more sellers than there are highly experienced and well-positioned financing experts with extensive buyer networks and sources to take care of a bargain. The returns of personal equity are generally seen after a few years.

What Does Custom Private Equity Asset Managers Do?

Flying below the radar of large multinational firms, several of these little firms typically offer higher-quality customer care and/or particular niche product or services that look these up are not being provided by the big corporations (https://issuu.com/cpequityamtx). Such benefits bring in the interest of personal equity firms, as they have the understandings and smart to exploit such possibilities and take the company to the following level

Private equity financiers need to have reputable, capable, and dependable management in position. Many supervisors at profile business are provided equity and reward payment frameworks that compensate them for hitting their economic targets. Such positioning of objectives is usually called for before an offer obtains done. Exclusive equity chances are typically unreachable for individuals who can not invest numerous dollars, yet they shouldn't be.

There are regulations, such as limitations on the accumulation quantity of money and on the number of non-accredited capitalists (Private Investment Opportunities).

A Biased View of Custom Private Equity Asset Managers

An additional drawback is the absence of liquidity; when in an exclusive equity deal, it is hard to obtain out of or offer. There is a lack of flexibility. Exclusive equity also includes high fees. With funds under monitoring currently in the trillions, private equity companies have actually become eye-catching investment lorries for well-off individuals and institutions.

For years, the attributes of personal equity have actually made the asset course an eye-catching suggestion for those who can participate. Currently that accessibility to exclusive equity is opening as much as more specific capitalists, the untapped possibility is ending up being a truth. The inquiry to consider is: why should you spend? We'll start with the main arguments for investing in personal equity: How and why private equity returns have actually historically been more than other possessions on a number of degrees, Just how including personal equity in a portfolio affects the risk-return account, by assisting to branch out versus market and cyclical threat, After that, we will outline some essential factors to consider and risks for private equity capitalists.

When it involves presenting a brand-new possession into a portfolio, one of the most basic consideration is the risk-return account of that property. Historically, exclusive equity has actually displayed returns similar to that of Arising Market Equities and higher than all various other typical property courses. Its fairly low volatility combined with its high returns produces an engaging risk-return profile.

The 7-Minute Rule for Custom Private Equity Asset Managers

In reality, private equity fund quartiles have the largest series of returns across all alternate property courses - as you can see below. Approach: Inner rate of return (IRR) spreads out computed for funds within classic years individually and after that balanced out. Mean IRR was calculated bytaking the average of the typical IRR for funds within each vintage year.

The result of adding personal equity right into a profile is - as constantly - dependent on the profile itself. A Pantheon research study from 2015 recommended that including personal equity in a portfolio of pure public equity can open 3.

On the various other hand, the very best personal equity companies have accessibility to an even bigger swimming pool of unidentified possibilities that do not deal with the same examination, as well as the resources to do due diligence on them and recognize which are worth buying (Private Equity Platform Investment). Spending at the ground floor indicates higher danger, but also for the firms that do prosper, the fund take advantage of greater returns

A Biased View of Custom Private Equity Asset Managers

Both public and exclusive equity fund managers dedicate to spending a percentage of the fund yet there stays a well-trodden concern with lining up interests for public equity fund management: the 'principal-agent problem'. When a financier (the 'primary') works with a public fund supervisor to take control of their resources (as an 'representative') they pass on control to the manager while maintaining possession of the properties.

In the case of private equity, the General Partner doesn't simply gain an administration cost. They also make a percent of the fund's earnings in the kind of "lug" (typically 20%). This ensures that the interests of the supervisor are lined up with those of the financiers. Private equity funds likewise alleviate one more type of principal-agent problem.

A public equity financier ultimately wants something - for the monitoring to increase the supply cost and/or pay out dividends. The investor has little to no control over the choice. We revealed above how many private equity strategies - specifically majority buyouts - take control of the running of the company, ensuring that the lasting value of the business comes initially, rising the return on financial investment over the life of the fund.

Report this wiki page